Immediate Supply of Information (SII)

Immediate Supply of Information (SII-AEAT) in JD Edwards

What is SII?

The SII is a new system for keeping VAT record books through the AEAT's electronic Headquarters that came into force on July 1, 2017.

This VAT management system based on the Immediate Supply of Information (SII) is a model that requires the electronic management of the tax registry books through the AEAT's Electronic Headquarters and which configures a new way in which taxpayers will relate with the Tax Administration.

Who has to adopt the new Immediate Supply of Information (SII) model?

The Immediate Provision of Information is mandatory for:

- Taxpayers registered in the VAT Monthly Refund Register (REDEME).

- Large companies (annual turnover greater than six million euros).

- Registered in the monthly VAT refund system.

This translates into more than 62,000 Spanish taxpayers. Optionally, any other taxpayer who wishes to do so, even if they do not meet these requirements, may opt for the system.

You can voluntarily opt for the SII or by filing the census declaration (boxes 143 and 532 of form 036) in the month of November prior to the beginning of the calendar year in which it is to take effect or at the time of filing the declaration of commencement of the activity, taking effect in the current calendar year.

How does the SII AEAT system work?

The management is carried out electronically, through Web Services based on the exchange of XML messages. Its procedure is automatic, which facilitates direct connectivity with the AEAT, and there is also the possibility for the taxpayer to interact with the Administration. This system is configured as an innovative mechanism, both to assist taxpayers and to improve and make tax control more efficient.

The new system is based on the collection of companies' invoicing details in real time, in fact, the regulations require companies to submit and declare the details of invoices issued and received within a period that should not exceed 4 calendar days.

How to deal with this change?

The adaptation to the Immediate Supply of Information - SII can be done autonomously or, leaving it in the hands of experts, hiring a technology consultant to take care of everything. That is to say, implementing an ERP that allows the configuration of the XML file to declare the books, according to the information required by the AEAT and the adaptation of the architecture to be able to publish and consume web services.

Likewise, a solution should be sought that offers direct integration services with the tax agency, both inbound and outbound, and that allows direct and online communication with the AEAT, including control of status and errors in the communication.

What is SII for JD Edwards and what does it consist of?

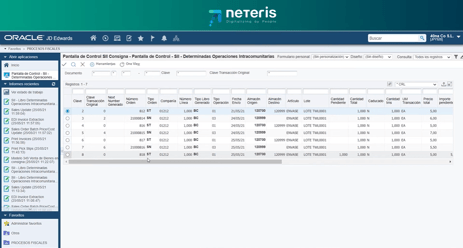

Since last July 1, 2017, when the SII - Suministro Inmediato Información (Immediate Information Supply) standard came into force, at Neteris we have been working on a solution through Web Services based on XML file exchange, integrating it with JD Edwards, so that our clients can meet the tax obligation.

The solution provided by Neteris includes the integration of the tax agency's response in the ERP and the ability to automate 100% of the process, without the intervention of end users.

|

|

The electronic keeping of Value Added Tax (VAT) record books improves communication between the taxpayer and the AEAT, being instantaneous and automated, almost in real-time.

VAT Modules

The 303 and 390 annual VAT returns are still manual after the implementation of the SII VAT (Immediate Information System).

Would you like to automate the filing of these taxes to send consistent and integrated information between the two returns?

Additional modules:

-

Module I - SII XML generation

-

Module II - SII WebServices Communication

-

Module III - SII response process

-

Module IV - 303 and 349 Declarations

JD Edwards integrated IBS features

- It is composed of several applications that incorporate configuration options necessary to map the tax configuration and types of invoices used by the company.

- It contemplates the usual operations such as: Books of invoices issued, received, auxiliary book of real estate, Books of Payments and Collections.

- Likewise, it can be configured to perform the entire generation and sending process in a fully automatic way, receiving notifications via email.

- Multi company and with support for both the national and regional tax authorities and the new regulation of the Canary Islands, which comes into force on January 1, 2019.

- Integrates the answers from the tax agency in the ERP, providing the CSV verification code in case the submission was correct, or the corresponding error messages.

It also has the functionality to:

-

Configure the formats of invoice numbers and series to be declared

-

Manage grouped invoices, summary invoices, cash receipts, etc.

-

Automatically detect corrected invoices and automatically present them in a correction mode.

-

Manage Dua, Deferred Dua, multiple properties per third party.

-

Configure the formats of invoice numbers and series to be declared

-

Manage grouped invoices, summary invoices, cash receipts, etc.

-

Automatically detect corrected invoices and automatically present them in a correction mode.

-

Manage Dua, Deferred Dua, multiple properties per third party.

Why Neteris

Neteris is an Oracle JD Edwards Certified and Specialized Partner. We have successfully led hundreds of JD Edwards implementations, migrations, transitions to CLOUD and integrations around the world in companies of various industries and sizes. Integrations around the world in companies of various industries and sizes, and we have proprietary solutions that extend and complement the functionality of Oracle JD Edwards.

We have our own team of specialists and certified consultants, in addition to a team of Innovation and development on Oracle JD Edwards, that allows our clients to exploit JD Edwards capabilities to the maximum and face any project with total guarantee of success.

We are currently one of the European partners with the highest level of product training, from the oldest versions to the latest update, from its earliest versions up to the latest update, the Release 23.

.png)

.png)

.png)

.png)

.png)

.png)

Propuesta de valor

Propuesta de valor