Last July, the new Anti-Fraud Law came into force, which will affect, among other things:

- dual-use accounting management software to ensure that business accounting is not falsified or altered;

- as well as limits on cash payments between companies and individuals.

The law requires that computerized systems for accounting processes (ERPs) comply with certain criteria to ensure:

-

Accessibility of records.

- Traceability of operations.

- Inalterability.

In addition, the software must a certificate issued by the Ministry of Finance.

Did you know that...

Most important changes in the law

- Cash payments are limited to €1,000.

- Regulation of house entries in procedures related to tax inspection.

- Reduction of the debt threshold with the tax authorities to appear on the list of defaulters (€600,000).

- Prohibition of tax amnesties.

- Measures against tax havens, the Cadastre, etc.

- Freezing of the registration tax.

- Control of cryptocurrencies both nationally and internationally.

Contact us and we will help you find out if your management system complies with the requirements of the new Anti-Fraud Law.

What can I do if my ERP does not comply?

It is time to bet on a complete ERP that meets the needs of a company, your size, your industry and your characteristics.

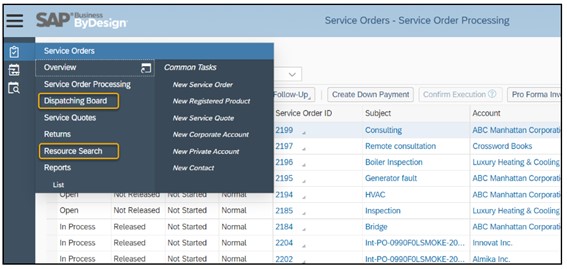

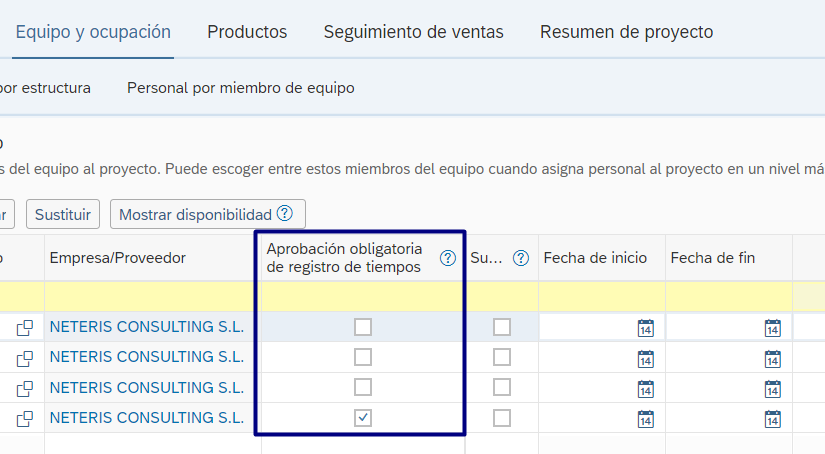

E here, if you are a medium-sized company, we invite you to evaluate the ERP Cloud SAP Business ByDesign, since all SAP solutions, including BYD, will meet the requirements of this law, so it will not pose any problem for its users.

here, if you are a medium-sized company, we invite you to evaluate the ERP Cloud SAP Business ByDesign, since all SAP solutions, including BYD, will meet the requirements of this law, so it will not pose any problem for its users.

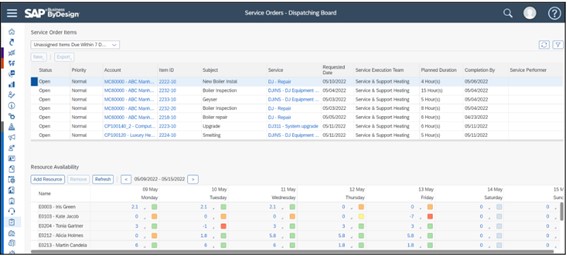

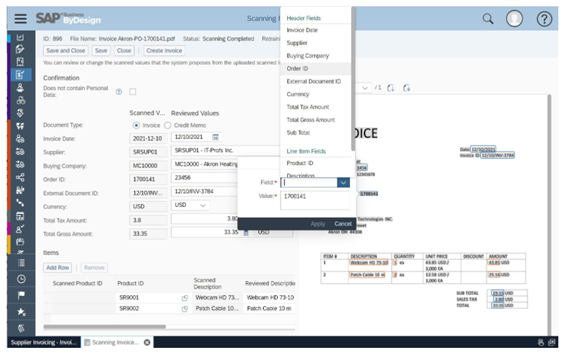

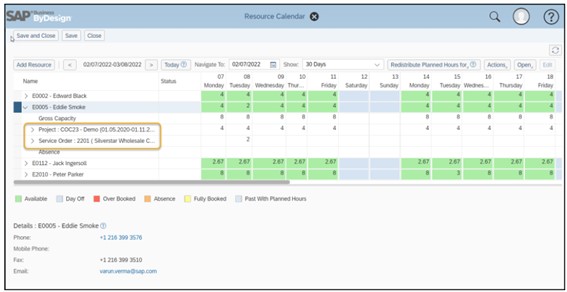

SAP ERP Cloud for MidMarket, in addition to complying with the new regulations, is a complete system that allows you to manage your accounting, automating and integrating internal processes and reducing potential errors.

-

Ensures compliance with budgets.

-

Control costs.

-

Visibility and control.

-

Leads financial collaboration between internal and external parties.

-

Efficiently manages the company's liquidity, with real-time visibility of open and pending positions.

-

Analyzes and optimizes the cash flow statement to maintain strict control of accounts receivable and accounts payable.

-

Real and updated information is always available.

.jpg?width=270&height=152&name=IMAGENES%20VARIADAS%20(2).jpg) Manage your business with a single solution of Cloud ERP for SMEs to scale and compete without complexity or cost.

Manage your business with a single solution of Cloud ERP for SMEs to scale and compete without complexity or cost.

Connect all the functions of your company with the best real-time and in-depth analytics.

It is characterized by:

- Intelligent ERP in the cloud: optimized end-to-end processes.

- Instant value: provides agility to adapt quickly to new opportunities.

- Business impact: real-time analytics included to help improve revenue and efficiency.

If you want it for your company. This solution is the most complete, integrated and specifically adapted for the Mid Market.

SAP Finances 45 days, a certified SAP solution

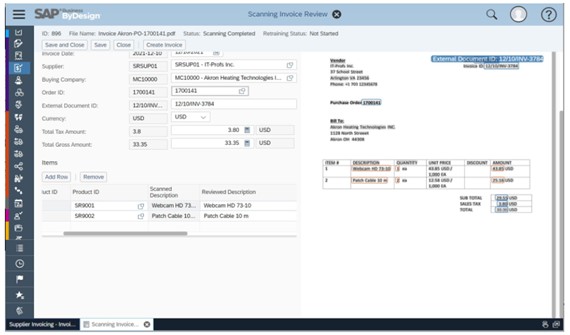

You will be able to analyze and optimize the statement of cash flow statement to maintain a strict control over accounts receivable control over accounts receivable and accounts payable, saving in the pay-as-you-go modality . pay-as-you-go.

In addition, it has an integrated as standard the Immediate Supply of Information (SII) for the electronic sending of your invoices to the AEAT.

This SAP financial module offers the possibilityto manage the entire business without great complexity or high costs.

Success Stories

Why Neteris

We are one of the SAP's main partners in Spain in the implementation of the ERP Cloud SAP Business ByDesign. We have been recognized as Best Resellers for several years and our extensive experience with the ERP has led us to develop several ADDONS (Complementary Solutions to the ERP) that have helped to expand and improve certain functionalities, and to certify (by the SAP manufacturer) several "PLUG AND PLAY" solutions for our customers.

It's time to improve business management, analytical and budgeting capabilities without major investments!

Propuesta de valor

Propuesta de valor

.jpg?width=1200&length=1200&name=Portadas%20YOUTUBE%20(3).jpg)

.png?width=400&height=74&name=LP%20BYD%20(2).png)